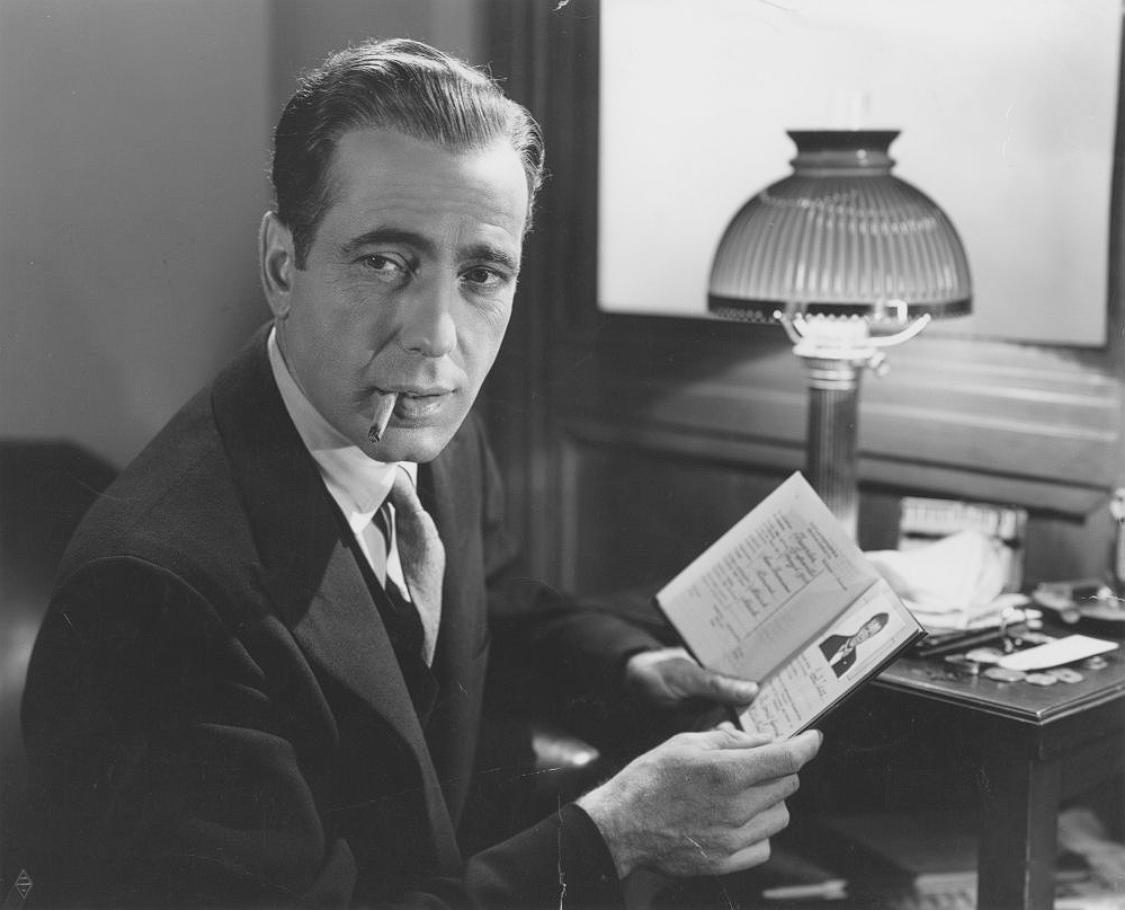

Humphrey Bogart, renowned for his iconic roles in classic films, was not only a Hollywood legend but also a shrewd businessman. His financial acumen, evident in his high salaries, strategic investments, and independent film production, ensured his family’s financial security for generations.

Bogart’s Path to Financial Success

Humphrey Bogart’s journey to financial success was marked by his strategic career choices and business savvy, setting him apart from many of his peers.

Early Career and Breakthrough

Bogart’s career began on the stage before transitioning to film in the 1930s, where he spent years in supporting roles before his breakthrough in 1941.

- Stage Beginnings:

- Bogart’s early career on the stage provided him with valuable acting experience and a foundation for his later film success.

- He started on the stage.

- Transition to Film:

- His transition to film in the 1930s marked a significant step in his career, though he initially faced challenges in securing leading roles.

- He transitioned to film.

- Breakthrough in 1941:

- His breakthrough came in 1941 with “High Sierra” and “The Maltese Falcon,” establishing him as a leading man and opening doors to greater opportunities.

- He had a breakthrough in 1941.

High Salaries and Lucrative Deals

Bogart’s rise to stardom allowed him to negotiate high salaries and secure lucrative film deals, contributing to his financial success.

- Casablanca Stardom:

- “Casablanca” (1942) cemented his place as one of Hollywood’s highest-paid stars, giving him leverage in contract negotiations.

- “Casablanca” made him a star.

- Careful Role Selection:

- He carefully selected roles in films like “The Treasure of the Sierra Madre,” “Key Largo,” and “The African Queen,” maximizing both his artistic impact and financial returns.

- He chose roles carefully.

- Financial Returns:

- His strategic role selection ensured consistent financial returns, contributing to his growing wealth and financial stability.

- He maximized financial returns.

Strategic Investments

Beyond acting, Bogart made strategic investments that sustained his family for generations, demonstrating his business acumen.

- Real Estate Investments:

- Bogart invested in real estate, recognizing its long-term value and potential for appreciation.

- He invested in real estate.

- Diversification:

- He diversified his investments, reducing risk and ensuring a stable financial foundation for his family.

- He diversified investments.

- Long-Term Security:

- His investments were aimed at providing long-term financial security, ensuring his family’s well-being beyond his lifetime.

- He focused on long-term security.

Business Acumen and Independent Production

Bogart’s business acumen extended beyond acting, as he ventured into independent film production and shrewdly managed his finances.

Santana Productions

In 1948, Bogart founded Santana Productions, an independent film company that allowed him greater control over his projects and earnings.

- Greater Control:

- Santana Productions gave Bogart greater control over his creative projects, allowing him to choose roles and influence production decisions.

- He had greater control.

- Increased Earnings:

- The venture significantly added to his wealth, as he received a larger share of the profits from his films.

- He increased earnings.

- Independent Ventures:

- Founding Santana Productions demonstrated his entrepreneurial spirit and his desire to break free from the restrictive Hollywood distribution system.

- He had independent ventures.

Selling to Columbia Pictures

Despite its success, the restrictive Hollywood distribution system eventually forced Bogart to sell Santana to Columbia Pictures, adding to his wealth.

- Distribution Challenges:

- The challenges of independent film distribution highlighted the power of the major studios and the difficulties faced by independent producers.

- There were distribution challenges.

- Financial Gain:

- The sale to Columbia Pictures resulted in a significant financial gain for Bogart, contributing to his overall wealth.

- He had financial gain.

- Strategic Move:

- Selling Santana was a strategic move that allowed Bogart to capitalize on his success while navigating the complexities of the Hollywood industry.

- It was a strategic move.

Estate Management

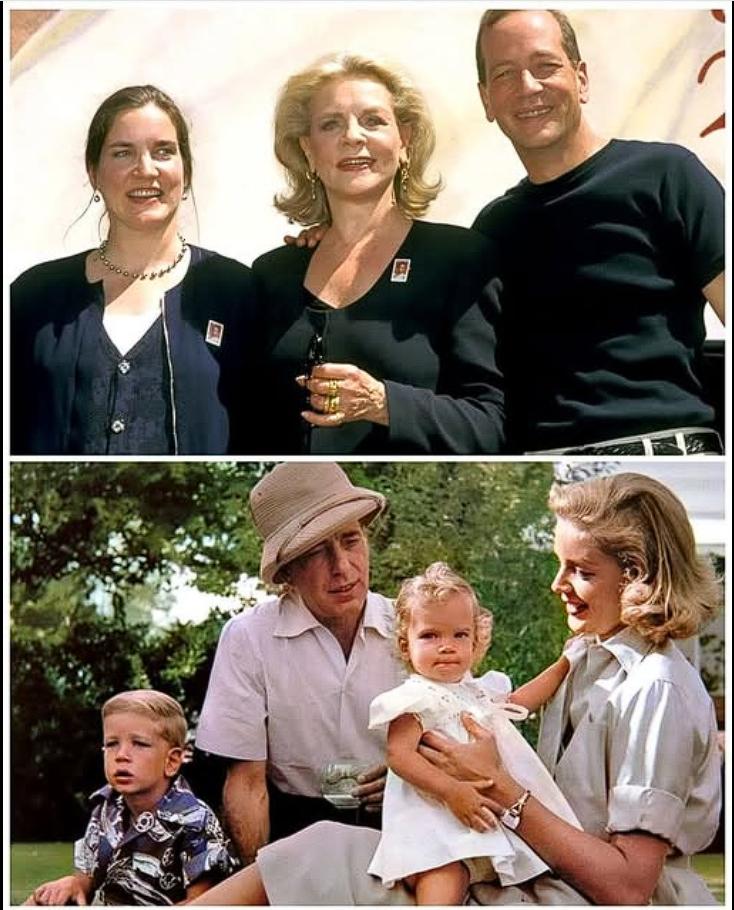

At the time of his death, his estate, valued at over 910,000 dollars, was left primarily to his wife, Lauren Bacall, who skillfully managed their assets.

- Lauren Bacall’s Role:

- Lauren Bacall played a crucial role in managing Bogart’s estate, ensuring financial security for their children.

- Lauren Bacall managed the estate.

- Asset Preservation:

- Bacall’s skillful management preserved and grew the estate, demonstrating her business acumen and commitment to her family.

- She preserved assets.

- Financial Security:

- Her efforts ensured the financial security of their children, Stephen and Leslie, for generations to come.

- She ensured financial security.

Legacy and Enduring Impact

Humphrey Bogart’s legacy extends beyond his film roles, encompassing his financial foresight and the enduring security he provided for his family.

Lauren Bacall’s Management

Lauren Bacall continued her successful acting career while making strategic investments in real estate and licensing deals, preserving Bogart’s legacy.

- Continued Career:

- Bacall continued her successful acting career, maintaining her own financial independence and contributing to the family’s wealth.

- She continued her career.

- Strategic Investments:

- Her strategic investments in real estate and licensing deals ensured the preservation of Bogart’s legacy and the continued growth of their estate.

- She made strategic investments.

- Estate Growth:

- By the time of her passing in 2014, her estate was worth over 26 million dollars, demonstrating her successful management and investment strategies.

- The estate grew.

Family’s Financial Future

The combined efforts of Humphrey Bogart and Lauren Bacall ensured the Bogart family’s financial future, providing security for their children and grandchildren.

- Generational Security:

- Their financial foresight provided generational security, ensuring the family’s well-being for decades.

- They provided generational security.

- Preserving Legacy:

- Their management of the estate preserved Bogart’s legacy, ensuring his name and image remained relevant and valuable.

- They preserved his legacy.

- Financial Stability:

- The family’s financial stability allowed them to pursue their own interests and passions, free from financial worries.

- They had financial stability.

Enduring Legacy

Today, Stephen Bogart oversees his father’s estate, keeping his legendary name alive through licensing agreements and branding, while Leslie chose a private life dedicated to health and wellness.

- Stephen Bogart’s Role:

- Stephen Bogart continues to manage his father’s estate, ensuring his legacy endures through licensing agreements and branding.

- Stephen Bogart manages the estate.

- Leslie Bogart’s Privacy:

- Leslie Bogart chose a private life focused on health and wellness, highlighting the family’s diverse paths and interests.

- Leslie Bogart chose a private life.

- Lasting Impact:

- Bogart’s legacy endures not just through his films but also through the financial foresight that kept his family secure for decades, showcasing his multifaceted impact.

- His legacy endures.

Humphrey Bogart’s story is a testament to the power of financial foresight and strategic planning. His ability to navigate the complexities of Hollywood and secure his family’s future highlights his multifaceted legacy, extending far beyond his iconic film roles.